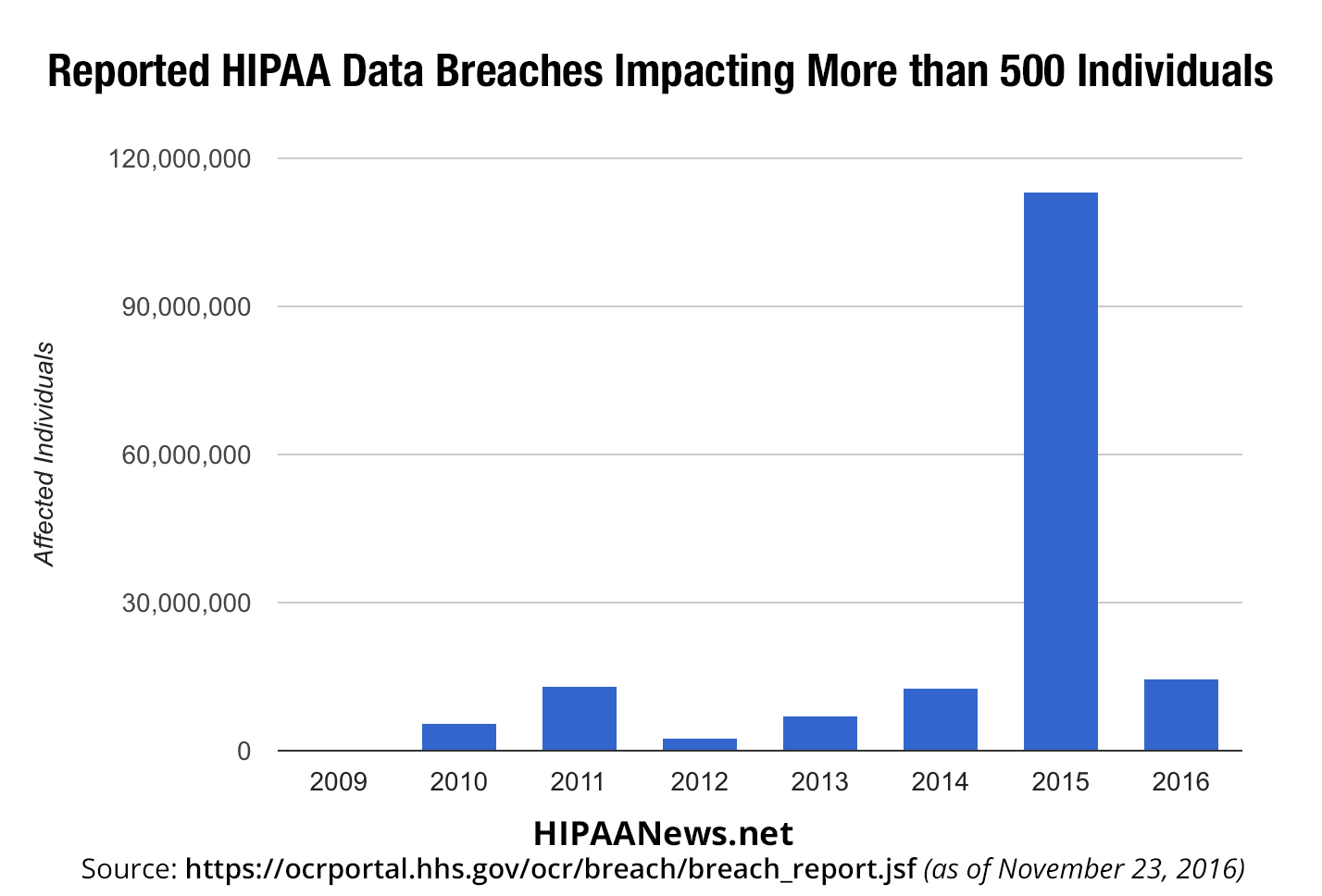

HIPAA Privacy Complaints

HIPAA Journal published an article online this week addressing client HIPAA violation complaints and whether or not health care providers are equipped to properly address these complaints. According to the article, in order for an efficient response to be conducted, policies should be developed covering the complaints procedure and staff must be trained to handle … [Read more…]